stamp duty exemption malaysia 2019

2 Order 2019 Amendment Order 2019 PU. 10 Year Exemption from Reporting Earnings Whose Source is from Abroad.

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Israel had a stamp duty on signed documents.

. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. This is effected under Palestinian ownership and in accordance with the best European and international standards. Stamp Duty Exemption No.

A full stamp duty exemption is given on loan agreement effective for. Ducation fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. 4250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program.

Stamp Duty Exemption No. 0 75720 0 - 6310 10 75721 108600 6311 - 9050 14. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-.

G Limited V Pemungut Duti Setem. Case Report. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount.

This exemption however shall only be applicable with the HOC 2019 Certification issued by REHDA SHAREDA or SHEDA. Collector Of Stamp Duty 3 Others. Low See Hee Sons Realty Sdn Bhd V.

2 Order 2019 PU. Basic supporting equipment for disabled self spouse child or parent. Returning residents or new immigrants and the companies that are under their direction are not obligated to report earnings that benefit from.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. A 81 Stamp Duty Exemption No.

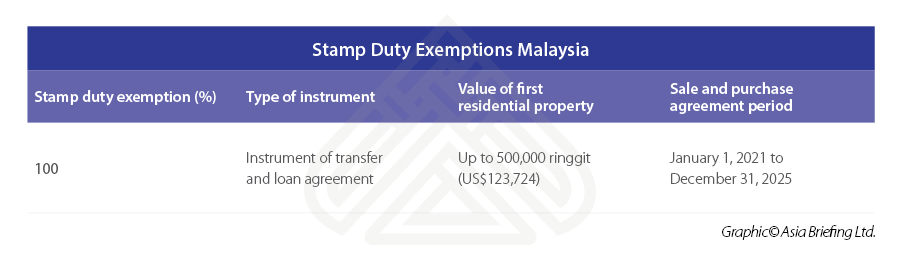

The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. Ultimately the Missions.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. Of Stamp Duty Exemption No. A 173 for purchase of property directly from a property developer.

Ground Judgment Refund of Stamp Duty. The stamp duty is to be made by the purchaser or buyer and not the seller.

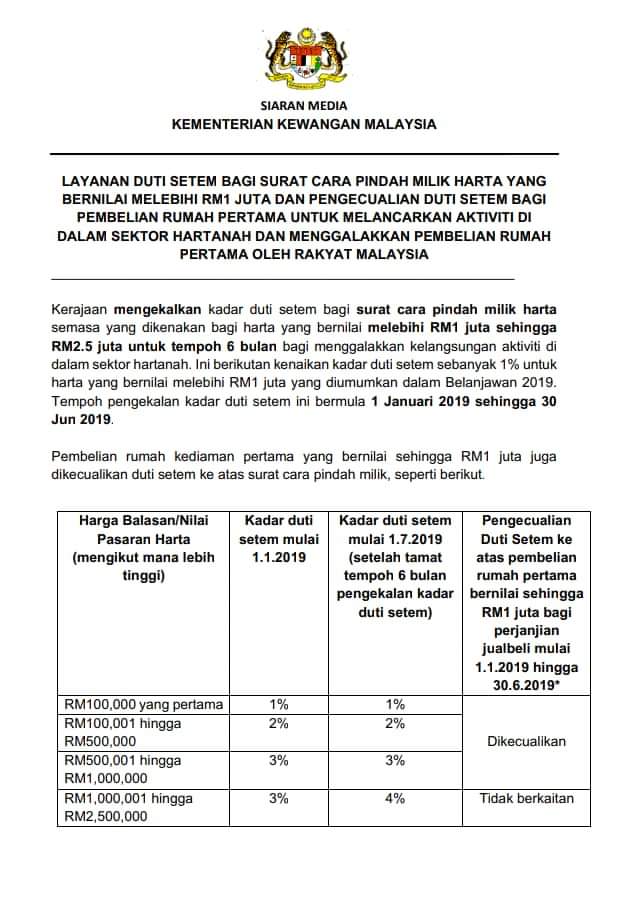

Finance Ministry Stamp Duty Exemption For First Time House Buyers From Jan 1 2019 The Star

Stamp Duty Increase For Properties Exceeding Rm1 Mln Now Effective July 1 2019

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

Malaysia S Budget 2020 Rodl Partner

Stamp Duty Exemption On Purchase Of Property Under Hoc 2020 2021 Ey Malaysia

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

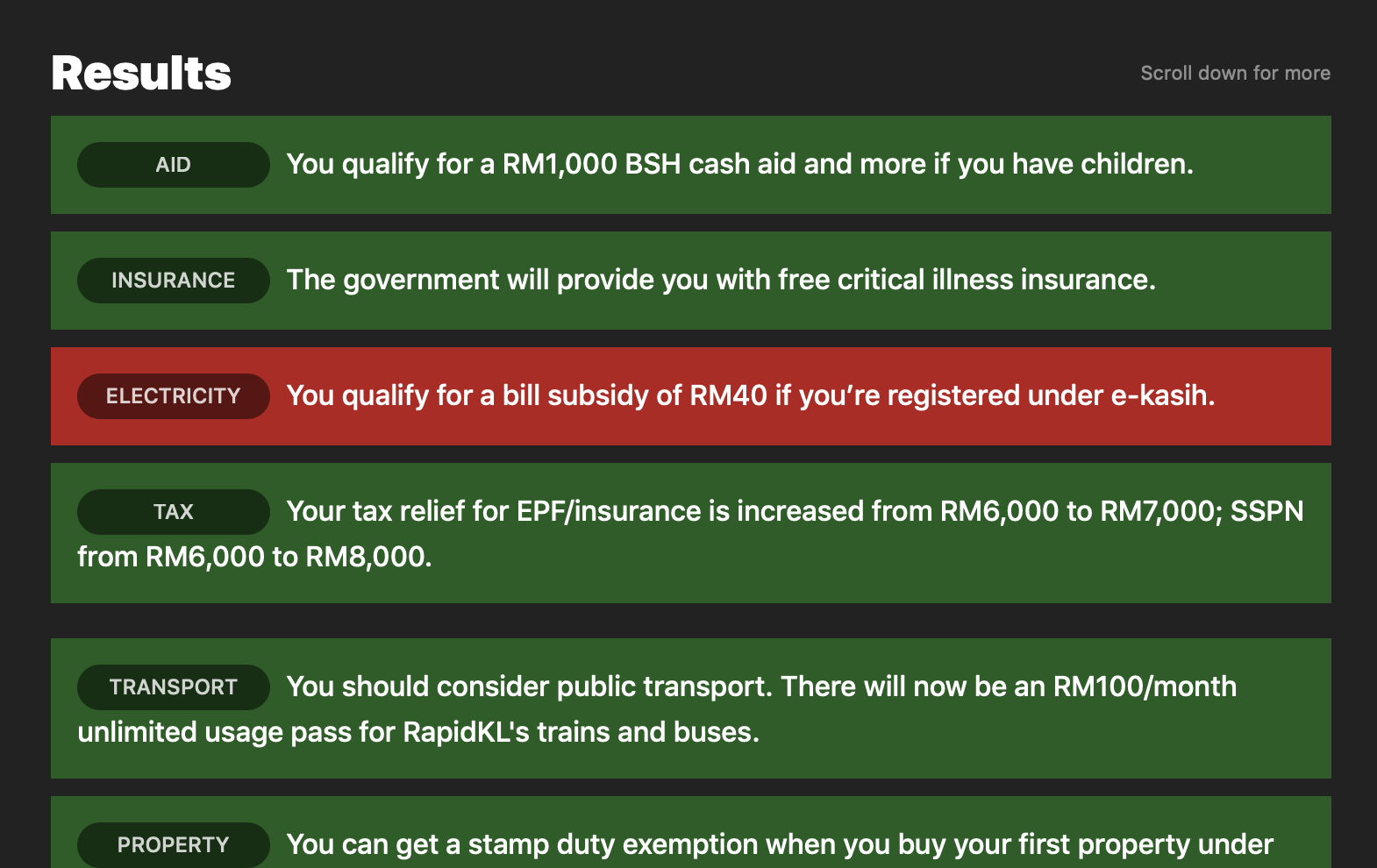

The 10 Best Digital Stories Of 2019 Part 1 Hackastory

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Budget 2019 Good News For First Time Homebuyers But Not For Investors Says Savills Malaysia Edgeprop My

Exemption For Stamp Duty 2019 2020 Youtube

Indirect Tax And Stamp Duty Measures In Malaysia For 2021

Stamp Duty Corporate Reconstruction Exemption Changes 2019 Deloitte Australia Tax

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Hoc Home Ownership Campaign Malaysia 2020 2021 All You Need To Know

Home Ownership Campaign Hoc Hsr Group